Backing Big Ambitions When They’re Small

Tiny VC, a stealthy and far too accomplished firm batting above its weight

In the mid-2010s, tech was getting hot in Europe - unless you were pre-revenue, pre-traction, or pre-fame. Then it was cold. Very cold. Amid this fickle landscape, two AngelList alumni - Philipp Moehring and Andy Chung – quietly set out to change the game for fledgling founders. In 2017, they launched the Tiny Supercomputer Investment Company, better known simply as Tiny VC, with a bold mantra: “backing great companies when they’re tiny.” Fast forward to today, and Tiny VC stands as one of Europe’s most prolific pre-seed investors, having backed over 400 startups since 2017. With modest check sizes (around €200k at pre-seed) and an emphasis on community and design over control, Moehring and Chung have built a fund that punches far above its weight, helping birth unicorns without ever insisting on the driver’s seat. Tiny VC’s evolution from an AngelList side-project into a pan-European kingmaker is a story of how staying tiny in approach can yield outsized impact.

Founding Story

Philipp Moehring and Andy Chung brought unconventional launchpads of their own into Tiny VC. Moehring was a well-known figure in Europe’s tech circles – a former Seedcamp associate who earned renown as a level-headed mentor, even being nominated as Best Mentor at the Europas Awards in 2013. He was later hand-picked by Naval Ravikant to spearhead AngelList Europe’s syndicates out of Berlin. Chung, meanwhile, had done stints in telecoms in the 2000s before cutting his teeth in venture at Eden Ventures. In the following years, Chung went on to co-found startups of his own, with varying success as Chung denotes them as ‘Multiple Failed Startups’ on LinkedIn, and ultimately joined AngelList in 2014. At AngelList, Chung helped build out the platform’s venture operations, facilitating investments in over 10,000 startups during a time of hyper-growth for the company as AUM scaled from $0 to $8 billion by 2021. Stationed in Berlin and London, and frequently shuttling to San Francisco, the duo had a front-row seat to thousands of early deals – and a firsthand view of the gap in Europe’s funding market for very early, very ambitious projects.

By late 2016, Moehring and Chung decided to fill that gap themselves. They envisioned a new kind of micro-fund that combined Silicon Valley reach with European grassroots hustle. In 2017, pooling their experience and networks, they quietly launched Tiny Supercomputer Investment Company I (the quirky name a tongue-in-cheek nod to making tiny bets on potentially super outcomes). Tiny VC’s DNA was set from the start: the fund would write small first checks into “ambitious and unique technology startups as early as possible”, and crucially, not act like a typical VC firm. Instead of leading rounds or taking board seats, Tiny would stay hands-off in governance while being hands-on in support – tapping into a network of experienced founders to help new startups find product-market fit, investors, and make good decisions. In essence, Moehring and Chung transplanted the AngelList ethos of empowering founders into a venture vehicle of their own. With Moehring based in Berlin and Chung in London, Tiny VC straddled two of Europe’s buzzing hubs from day one, giving it an enviable pan-European deal flow. The fund’s unusual setup (just two partners and their connections at first) allowed it to move quickly and independently – akin to a lean angel syndicate – at a time when most European VCs were larger, slower beasts. Tiny’s first fund was proof that this angel-powered model could work at scale.

Over the next couple of years, as Tiny’s portfolio swelled into the dozens, the need for backup became clear. Moehring and Chung began assembling a small but diverse team to support their growing community of startups. They formalised Tiny VC as a proper fund and added new faces with complementary skills. Early additions included Ophelia Cai, who joined as a Partner focused on investing and community, and Sandra Lyness to anchor operations and finance. Tiny VC’s team today looks nothing like a traditional finance outfit – and that’s by design. Moehring and Chung have brought together people that are investor-designer hybrids, lawyers-turned-operators, and an ex-founders turning to the dark side (venture capital grrr). This mix of backgrounds reflects Tiny’s ethos of giving startups more than just money – whether it’s design critiques or fundraising savvy, someone on the team has it covered. And importantly, the fund remained a tight-knit operation with no outside LP committees pressuring for quick returns. In fact, Tiny’s capital base has largely come from like-minded backers who buy into its long-term, “stay tiny” philosophy. This freedom from convention allowed Tiny VC to double down on its original game plan: be the earliest believer in wild ideas, and be the friendliest partner a founder could ask for.

So who’s behind Tiny now?

The Tiny VC team has evolved from that two-man band into a small ensemble of specialists – each with an interesting twist to their story. At the helm are still Andy Chung and Philipp Moehring, the co-founders and Partners driving Tiny’s investment strategy. Chung (who studied Natural Sciences at Cambridge) is the fund’s resident “infrastructure guru,” known for his prior life scaling AngelList and even some early angel bets on hits like Monzo and Sorare (experience that certainly doesn’t hurt Tiny’s deal selection). Moehring, for his part, wears the hat of “fundraiser-in-chief” and European scout – his years connecting founders and investors across Berlin, London and San Francisco made him one of the best-networked early-stage investors on the continent. While he’s busy hunting deep-tech moonshots now, Philipp has mused about wanting to buy a farm someday - proof that even futurists think about unplugging. Like most who have spent enough time in SF, Moehring has a Goodreads account with more sci-fi recommendations than a crypto founder has Discord servers.

Surrounding the founders is a lean team of six that punches well above its weight. We have Ophelia Cai, a Partner who spearheads Tiny’s community efforts – she’s often the first call for portfolio founders looking for a mentor or a morale boost. Ophelia’s background spans continents (she’s worked across Asia and Europe) and her superpower is said to be connecting founders to exactly the person they need to talk to. On the investment side, Utku Can brings a designer’s eye to the cap table; formerly a product designer, Utku ensures Tiny’s startups get UX feedback and branding tips alongside funding. The operational backbone comes from Sandra Lyness (Partner, Ops & Finance) and Harriet Dedman (Legal & Ops), who keep Tiny running tight and help startups navigate legal and financial hurdles from day one. Lyndsey Garrett is the dedicated Accounting, bringing financial rigour from her past at Passion Capital and ensuring smooth fund operations. Rounding out the squad is Alex Gezelius, an investor who also focuses on community building – think of him as Tiny’s bridge between the 600+ founders in the portfolio network and the next generation of Tiny-backed entrepreneurs. With such eclectic talent on board, Tiny VC has essentially built a micro “founder services” platform: whether a startup needs design polish, hiring contracts, or just someone who’s been through the wringer to talk to, someone at Tiny (or in its community) can help. This team may be tiny in number, but they pack a wealth of experience that belies their size – living proof of Tiny VC’s philosophy that size doesn’t limit impact.

Investment Stuff: Thesis, Portfolio, Track Record

Thesis

From its inception, Tiny VC’s investment philosophy has been simple on the surface – sector-agnostic, pre-seed investing – but distinctive in execution. Moehring and Chung set out to find exceptional founders tackling “ambitious and unique” problems with technology, often before others pay attention. In practice, this means Tiny VC is unafraid to back ideas that might seem too early, too small, or too unorthodox to attract conventional VCs. The firm’s mantra of “backing great companies when they’re tiny” isn’t just marketing; it reflects a genuine contrarian streak. For example, while many funds chase the hottest crypto or fintech trend of the moment, Tiny has happily placed bets in overlooked corners like legaltech for small law firms and even outer-space data centres. As Philipp Moehring has previously alluded to, they actively encourage founders to be extreme in their vision – to pursue ideas others might label crazy – because those can become the biggest breakthroughs. It’s a mindset that Tiny’s team shares: think big, even at pre-seed.

Being “generalist” at pre-seed doesn’t mean scattergun investing. Tiny VC gravitates towards startups with a technological edge or a defensible product in the making. Both partners have a love for deep tech and infrastructure (fitting, given Moehring’s years at tech accelerators and Chung’s engineering background). This led Tiny to early bets in areas like artificial intelligence, dev tools, and frontier hardware well before they were in vogue. Critically, Tiny’s process puts founder quality and potential above all else – metrics hardly exist at pre-seed, so they look for unusual sparks in a founder’s background. If a team has an outrageously bold plan that others doubt, Tiny leans in so long as the founders have the grit and talent to pursue it. This high-conviction approach is enabled by Tiny’s unique structure: since they don’t lead rounds or take board seats, they can close deals fast and on founder-friendly terms, often partnering with other seed funds rather than competing with them. In fact, Tiny frequently co-invests alongside firms like Seedcamp, LocalGlobe or Entrepreneur First, acting as the “friendly angel” in the round. The benefit of not leading is that Tiny never slows a round down – they’ll happily join a syndicate of 5-6 investors, add their €200k, and then help the founders syndicate a larger round through introductions. This collaborative ethos has made Tiny a favourite co-investor for many lead VCs and a secret weapon for founders who need that extra bit of capital and network to get off the ground.

Another hallmark of Tiny’s thesis is geographical open-mindedness. Where some funds stick to Silicon Roundabout or Berlin’s Factory scene, Tiny VC will scour anywhere from Sofia to Ljubljana to Tallinn for great teams. Moehring’s and Chung’s AngelList days taught them that talent is everywhere, so Tiny has backed startups across more than 10 countries (with a focus on Europe) and counting. They were one of the first international funds to invest in startups from Bulgaria, Slovenia, and Estonia that later went global. This broad lens allows Tiny to catch hidden gems that hometown investors might overlook. And thanks to their community approach, a founder in a smaller ecosystem backed by Tiny suddenly gains connections in London, Berlin, and San Francisco through the Tiny network. In summary, Tiny VC’s thesis boils down to “people with huge potential, attacking valuable problems, at the earliest stage”. They’ll go anywhere and consider any sector for that, but they’ll hold out for founding teams that have a spark – those rare teams that, as Tiny puts it, “make unique technology” and aim to transform how we live, work, or play.

Portfolio & Track Record

Despite its relatively small fund size, Tiny VC has built a portfolio that any big-name venture firm would envy. Over the years, Tiny has invested in hundreds of startups, and a remarkable number of those have blossomed into category leaders, unicorns and soonicorns, or high-profile success stories. To put it plainly, Tiny’s hit rate is anything but tiny. Let’s spotlight a few of the standouts that Tiny spotted when they were just seedlings:

Synthesia

When Tiny VC first backed this London-based AI startup in 2018, generative video was a nascent, slightly sci-fi idea. Synthesia’s founders were building a platform to create personalised synthetic videos with AI avatars – a concept far outside the mainstream at the time. Tiny joined a $3.1M seed round alongside investors like LDV Capital and Mark Cuban, lending early credence to Synthesia’s vision. That bet has aged spectacularly. Synthesia is now the world leader in AI video generation, used by thousands of companies to produce content without cameras. As of today, Synthesia has raised over $330M and hit a $2.1B valuation, cementing its status as one of the UK’s most valuable AI scale-ups. Not bad for a startup that many initially dismissed as a deepfake novelty. Tiny’s willingness to jump in early, when the idea was unproven, helped give Synthesia the runway to prove everyone else wrong.

Payhawk

Since Tiny has never been constrained by geography, Payhawk is Exhibit A. Hailing from Sofia, Bulgaria, Payhawk set out to build a unified spend-management platform for European businesses – essentially a “Brex for Europe” handling company cards, expenses, and bill payments. Moehring and Chung spotted Payhawk’s potential at pre-seed and got on board early. The company quickly gained traction by replacing clunky expense processes with a sleek all-in-one solution, and by 2022 Payhawk became Bulgaria’s first-ever unicorn after a Series B extension led by Lightspeed valued it at over $1B. It’s a textbook case of Tiny VC venturing beyond the usual hubs and reaping the rewards as Payhawk has now expanded across London, Berlin, Barcelona and beyond. For Tiny, being on Payhawk’s cap table from the start not only delivered financial returns but also signalled to the ecosystem that great startups can come from anywhere, not just Silicon Valley or Shoreditch.

Ready Player Me

Few investors were talking about the “metaverse” when Tiny invested in an Estonian avatar startup originally known as Wolf3D. Tiny VC, however, saw promise in what later became Ready Player Me – a platform enabling users to create a 3D avatar that travels with them across games and virtual worlds. This interoperable, cross-game avatar concept positioned Ready Player Me as a critical piece of the future metaverse infrastructure. Tiny’s early belief paid off when in 2022 Andreessen Horowitz’s a16z led a $56M Series B into the company. Ready Player Me avatars are integrated into hundreds of apps and games, and the company is heralded as one of Europe’s rising stars in gaming tech. Tiny’s participation in Ready Player Me’s journey again shows its knack for anticipating trends – in this case, the convergence of gaming, identity, and Web3 – and supporting them well before they become headlines.

n8n

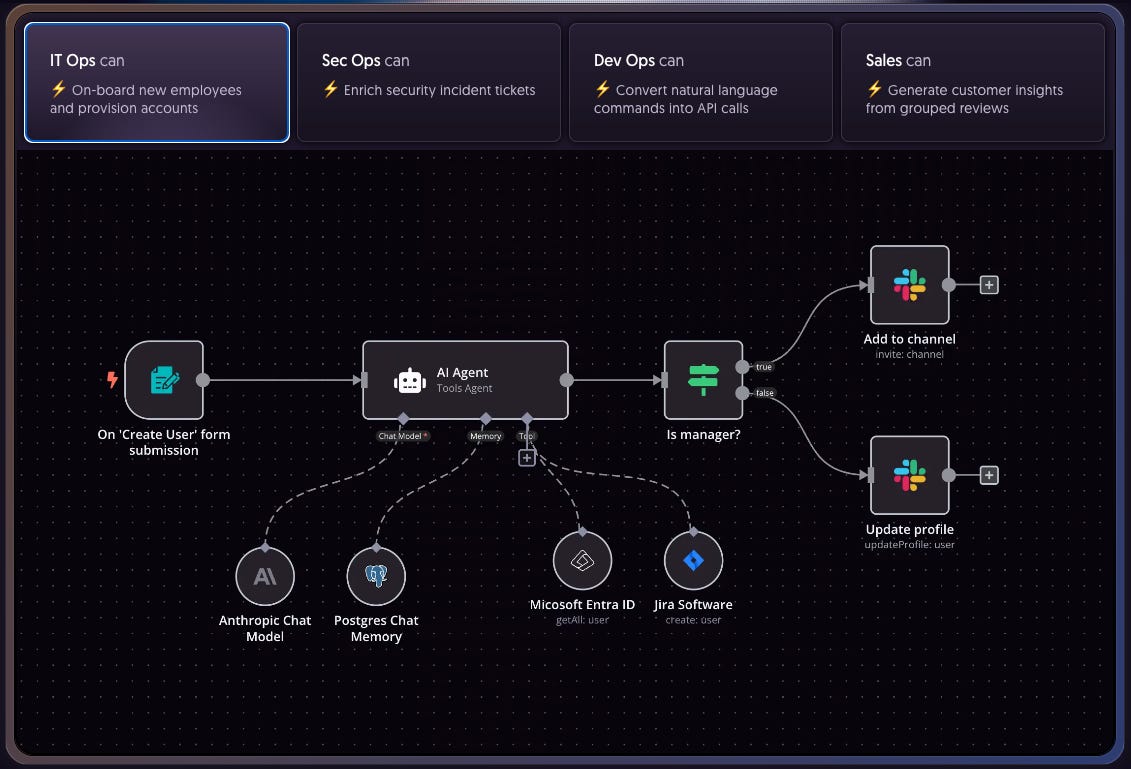

In the realm of software, Tiny VC scored a win with n8n, a Berlin-founded startup that took on giants like Zapier by offering a workflow automation tool that is open, flexible, and “fair-code” (allowing source-code access). Tiny was among the first backers of n8n, attracted by founder Jan Oberhauser’s vision to empower developers and non-developers alike to build custom automations beyond the limits of closed SaaS tools and as n8n becomes the foundation of the AI agent trend we have come to see. That bet has paid off handsomely: n8n’s userbase exploded thanks to its community-driven approach, and by 2023 the company raised a €55M Series B led by Highland Europe (with previous investors like Sequoia and Felicis also in the mix). Sources say this round valued n8n around €250M – not quite a unicorn yet, but firmly on the path. For Tiny, which wrote one of the first checks, n8n’s rise validates the strategy of backing strong technical founders in strong sectors like enterprise automation. Solving repetitive workflow problems has proved to be a lucrative niche, and Tiny was there from the get-go.

Lawhive

One of our favourites is Lawhive, a UK-based legal tech startup that decided to serve the thousands of small “Main Street” law firms rather than big global law firms. Where most legal tech ventures, like Harvey, for example, chase large corporate firms with hefty budgets, Lawhive built an AI-driven SaaS platform to help local solicitors and small practices streamline their work at an affordable cost. Tiny’s early support helped Lawhive carve out this underappreciated market. The result? By 2024, Lawhive raised a $12M seed round led by GV (Google Ventures) to expand from the UK into the U.S. The company’s AI assistant “Lawrence” even passed the UK legal exams, and Lawhive is now touted as a game-changer for making legal services more accessible. Tiny VC’s role here exemplifies its love of “overlooked and unsexy” sectors – backing a startup improving small law firms’ efficiency isn’t flashy, but it creates real value that big VC eventually noticed (hence GV’s involvement). For Tiny, seeing Lawhive go from a scrappy idea to a venture-funded scale-up has probably been immensely rewarding, and it underscores their thesis that boring problems can hide big opportunities.

Of course, these are just a few highlights. Tiny VC’s portfolio spans everything from fintech to biotech to hardware. They were early into Lifebit (an AI-driven genomics platform), Gtmhub (OKR software which went on to raise $120M), and countless others forging new paths. What’s most striking is how many of Tiny’s companies have not only raised follow-on funding, but become leaders in their categories. By 2023, Tiny VC had quietly become one of Europe’s most active seed investors – in fact, industry observers have called Moehring “Europe’s most active investor” for the sheer number of deals he does. Importantly, it’s not just activity for activity’s sake; Tiny’s companies consistently graduate to the next level. Many have been picked up by top-tier VCs at Series A or B (Sequoia, Index, Accel, you name it), validating Tiny’s early picks. And there have been some exits too.

Future Bets: Sunrise, Starcloud and Beyond

Tiny VC isn’t resting on its laurels. The fund continues to push into even more frontier territory with its latest bets – the kind that sound like science fiction but could define the next decades. A great example is Sunrise Robotics, one of Tiny’s recent investments tackling Europe’s manufacturing crisis. Based in Slovenia, Sunrise is building intelligent robotic cells to automate factory tasks amid labour shortages. It emerged from stealth in 2025 with an $8.5M seed round led by Plural, and Tiny VC eagerly joined the cap table. Sunrise’s approach of using dual-arm robots trained in virtual simulations promises to radically cut deployment time for factory automation – potentially a game-changer for Europe’s industrial base. By backing Sunrise at seed, Tiny is effectively betting that AI-driven robotics will reinvent manufacturing for a new era (and judging by Sunrise’s early traction, that bet is looking sound).

Then there’s Starcloud, perhaps Tiny VC’s boldest bet to date – and certainly the most out-of-this-world. Starcloud is a startup literally aiming to put data centres in space. While most investors are still nervous about space tech, Tiny didn’t flinch at the audacity of Starcloud’s vision. The company, a YC alum, is designing advanced power and cooling systems to operate massive server farms in orbit, leveraging 24/7 solar energy and the cold of space for efficiency. In 2024, Starcloud raised one of the largest pre-seed rounds ever for a space startup (over $20M total in a SAFE) and Tiny VC was right there among the early backers. The idea may sound crazy – megawatt-scale data centres circling Earth – but if it works, it could solve the land and energy constraints plaguing terrestrial data centres. Tiny’s willingness to underwrite such a far-fetched idea is a testament to its frontier mindset. With Starcloud, Tiny VC is effectively planting a flag in the space infrastructure sector before most of the venture world wakes up to it.

These future bets highlight an important aspect of Tiny VC’s track record: constant evolution. Moehring and Chung are always scanning the horizon for what’s next – whether it’s quantum computing, climate tech, or something as wild as nuclear waste recycling (another recent Tiny investment is Transmutex, a Swiss startup using particle accelerators to transmute nuclear waste).

To conclude...

In a very real sense, Tiny VC has become an embodiment of its founders’ core belief: that even the smallest startup can have a super-sized impact with the right early support. The name Tiny Supercomputer Investment Company might be playful, but it doubles as a lot more – small inputs (tiny startups, tiny checks) compounded into huge outputs (supercomputer-scale companies). From their AngelList-forged beginnings to the pan-European powerhouse they are today, Moehring and Chung have shown that staying true to a founder-first, patience-first ethos can build a lasting franchise. Tiny VC is now beloved by founders and co-investors alike, known for its quick yes’s, helpful nature, and uncanny nose for talent. And by operating on their own terms – “stay tiny” as the team likes to say – they’ve avoided the baggage that slows traditional funds. The result is a portfolio with a golden touch: a few unicorns, numerous high-growth successes, and a legion of loyal founders who proudly wear the Tiny VC alum badge. In the often ego-driven world of venture capital, Tiny has carved out a refreshingly humble and impactful niche. They prove that you don’t need a giant fund or a big ego to back the next big thing – sometimes staying tiny is the surest way to be mighty.

If you enjoyed this deep dive (because God are these a stealthy crew), subscribe for more insights in the coming weeks. For shorter takes and updates, follow us on Twitter/X and Instagram at @thesonofmasason – we’ll be sharing more venture tales there soon.